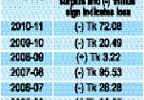

The aggregate loss of Bangladesh Petroleum Corporation (BPC) skyrocketed to Tk 72.08 billion in the last fiscal year (FY) 2010-11, up by 251 per cent over the previous fiscal’s Tk 20.49 billion.

The purchase of a substantially higher quantity of petroleum products from the international market at increased prices and the sale of the same in the domestic market at below procurement cost, were largely responsible for such hefty losses of the BPC during the year, a top official said Friday.

He said BPC imported around 5.10 million tonnes of petroleum products, including refined and crude oil, in FY 2010-11. The quantity was 38.66 per cent higher than that of 3.75 million tonnes imported in fiscal 2009-10.

The corporation’s imports increased mainly in order to keep the newly-installed diesel and furnace oil-fired power plants operational. The demand of other sectors including industries, irrigation, transportation and residential apartments also rose during the year, according to an official source.

Concerns over the global supply situation, in the wake of volatile political developments in the oil-rich Middle East and north African countries, also led to a surge in oil prices in the international market. That furthermore contributed to the BPC’s massive operational losses last fiscal, said the official.

Bangladesh did not increase domestic petroleum prices for most part of the last fiscal, in line with the uptrend of the oil prices in the international market, notwithstanding repeated urgings by the multilateral capital donors for going for appropriate adjustments of domestic prices of oil products.

The government, however, raised last time the domestic petroleum prices on May 6 this year to help reduce losses of cash-strapped BPC and to offset the impact of higher oil prices in the international market on the domestic economy.

Since then, diesel is being sold at Tk 46 per litre, kerosene, at Tk 46 per litre, petrol, at Tk 76 per litre, octane, at Tk 79 per litre and furnace oil, at Tk 42 per litre in the domestic market.

BPC Chairman Md Muqtadir Ali expressed the fear that the corporation’s loss might mount further as the country would require to import more petroleum products in future to meet the growing domestic demand.

Officials said in the past ten years of its operation, BPC made profit only in fiscal 2008-09 and fetched then Tk 3.22 billion in operational profits when oil prices in the international market showed a downward trend, following global economic meltdown.

BPC incurred losses of Tk 95.53 billion in fiscal 2007-08, Tk 26.28 billion in fiscal 2006-07, Tk 31.67 billion in fiscal 2005-06, Tk 28.99 billion in fiscal 2004-05, Tk 9.67 billion in fiscal 2003-04, Tk 5.21 billion in fiscal 2002-03 and Tk 6.45 billion in 2001-02, statistics revealed.

Earlier, the corporation’s loss in fiscal 2007-08 was significantly at a higher level, as domestic petroleum prices were then disproportionately low, despite a steep rise of oil prices in the international market, said a BPC official.

Bangladesh’s petroleum imports have been rising significantly as it is trying to diversify its electric power sources by setting up dozens of diesel- and furnace oil-run power plants to reduce dependence on natural gas for electricity generation.

Country’s natural gas-supply shortfall of around 500 million cubic feet per day (mmcfd) is also forcing many industries to convert their gas-burnt generators and boilers into diesel- or furnace oil-fired ones. This has been inflating the domestic petroleum demand, industry insiders said.

Currently, around 81 per cent of the country’s power plants are now running on natural gas and the remaining 19 per cent are using furnace oil, coal, hydro-power and gas oil.

Electricity generation by renewable energy sources like solar panel, windmill and biogas is still negligible.

The overall generation is now hovering around 4,500 megawatts (mw) against the demand for over 6,500 mw.

https://www.thefinancialexpress-bd.com/more.php?news_id=143035&date=2011-07-16