Bangladesh Power Board (PDB) has recently announced a mega plan for 7000 megawatts (MW) coal-based power generation. This they say is in accordance with the revised power sector master plan. Ten such plants will use about 20 million tonnes of imported coal (US$ 2.0 billion worth) a year. The board in its ambitious plan opined that such a massive investment would be possible from current rate of growth of export and industrialisation. If that really happens, Bangladesh will join middle income group of countries after 2016.

We are aware that Bangladesh GDP is growing at 5.0-6.0 per cent every year requiring about 7.0-8.0 per cent growth in power demand. But over the past several years power generation and supply could not keep pace with economic growth and industrial development. The present power demand at the peak irrigation season is about 7500MW against which average generation is about 5000MW. Over the last three years of the present government, several imported liquid fuel-based expensive rental power plants have been set up but the generation of many existing plants have become uncertain and inefficient for overage and outdated technology. Moreover, lack of natural gas supply at required volume and pressure translates into 800MW available capacity remaining idle. Consequently, about 2500MW deficit in national power grid has brought industrial growth and development to almost standstill situation. Thus not only foreign investment but also investment of local entrepreauners has become extremely challenging.

The Sixth Five Year Plan recognised prevailing energy situation as an acute energy crisis — a sectoral “emergency”. The annual loss of production and income from power outage could exceed 0.5 per cent of GDP per year. One of the main reasons for such mono fuel energy generation is the lack of required development of natural gas resources and failure to diversify fuel mix. The availability of domestic primary fuel supply is getting scarce forcing the shutting down of fertiliser factories, rationing gas supply for domestic use and CNG.

PDB estimated that if the country does not opt for coal now it will have to rely on import of US$ 8.0 billion worth of liquid petroleum at the present market rate to generate about 7000MW additional power.

We are not sure what made PDB to be so optimistic about relying on imported coal-based power and assurance of stable price of power in the volatile coal market. Bangladesh does not have required port infrastructure to support such a huge volume of coal import. Neither inland waterways retain all-season navigability for plying of coal carriers. Power based on imported coal under no circumstances can be cheaper than local coal and gas.

PDB also realised [may be contested by Petrobangla] that persistent gas crisis may worsen after 2017. PDB apprehension is not supported by massive expansion plan of Petrobangla. International oil companies and BAPEX are continuing major gas exploration and development activities. Petrobangla plans to add another 1000MMCFD gas supply to national grid by 2015 of which Chevron alone may add about 500MCFD. Petrobangla is also pursuing import of 500MMCFD equivalent LNG by 2013. If all these happen, then PDB may not need to go for such ambitious and to some extent unrealistic coal import plan.

There is nothing wrong in planning for shifting of 50 per cent of the power generation on coal to protect and preserve depleting precious gas resources.

PDB plan also indicated that by 2020 about 9800MW power will be generated from domestic coal and another 7,800MW from imported coal at a total cost of US$ 26 billion. According to PDB the remaining power would be generated using gas, oil, renewable energy and these would need US$13 billion more in investment.

The government forecasts the demand for power in 2020 will go up to 17,600 MW. It will jump to 24,956 MW in 2025 and 33,000 MW in 2030.

The government appears keen on importing expensive coal from the volatile global coal market than exploiting its own sweet coal lying at mineable depth. The government is still on hibernation as regards coal policy and appears confused about mining methods. It is highly unlikely that government in the remaining two years of its term will take positive decision of mining our own coal .

Mining professionals, economists and the Parliamentary Standing Committee for Power, Energy & Mineral Resources strongly favour mining of our own coal applying modern technology for recovering maximum amount of coal and setting up of mine-mouth power generation plants. According to conservative estimates, about 20,000MW power for 50 years can be generated using our own coal if properly explored and exploited. All the environmental and social impacts that inexperienced and some ill-motivated activists are raising can be professionally addressed. Coal will not be required to be transported anywhere using any mode of transport as power plants will be set up at mine mouth. Power generation using our own sweet coal will be much cheaper than imported coal. Moreover, our coal has little sulfur and little ash. It is of higher heating value as well.

In the light of this, the government formed the Coal Power Generation Company of Bangladesh two months back. The company’s main task is to spearhead all future public sector coal-based power projects, says PDB Chairman Alamgir Kabir.

“In addition, the company will develop local coal fields and import coal,” he said. The Power Division is now holding shares of this company. It (company) will hire a consultant to determine which would be the most suitable coal-field for fast development, and other procedures will follow.

According to the draft coal policy, the measured and probable coal reserves of the country total 3.3 billion tonnes in five fields. The measured coal reserve that can be mined for the time being is estimated to be 1,168 millon tonnes, except in Jamalganj where coal seams are located in deep underground. Meanwhile, the PDB has taken initiatives to set up 10 coal-fired plants in Khulna, Chittagong, Dhaka, Barisal and Barapukuria in Dinajpur.

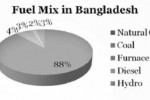

The fuel mix that existed in early 2009 has considerably changed now in 2012. Introduction of import of liquid fuel [diesel and furnace oll] has reduced the contriobution of gas to 67/ 70 per cent and increased liquid fuel contribution to 27 per cent. The liquid fuel-based contingency plants were mostly set up for 3 years and some for 5 years. But as PDB could not yet set up new gas- and our own coal-based plants, the government will now be compelled to continue with expensive contingency plants for some more years. These plants are expensive in the sense that BPC has to import diesel and furnace oil at international price and supply fuel to the plants at subsidised price or in other words, PDB has to purchase power at cut-throat price and supply to end-users at much lower price. The government has to account for huge amount of subsidy to BPC and PDB to let them survive.

In its eagerness to set up imported coal-based power plants the government has already signed a joint venture agreement with India [BPDB & NTPC] for a 1320 MW coal-based power plant at Bagerhat near Sundarbans.

The government is actively enaged in talks with China and Malaysia for two more similar plants at Chittagong and Cox’s Bazar. PDB has inked an agreement with local Company Orion for three medium-capacity power plants totaling a total 1187 MW imported coal-based plants. According to PDB, coal will be imported from Indonesia and these plants are expected to come on stream by 2015. Considering the non-availability of required port facilities for import of coal the target appears extremely challenging.

Regarding inland transportation of coal, PDB Chairman thought that transportation of coal in inland water would be same as transporting cement and steel. Power plants will need continuous supply of required amount of coal. Because of its spontaneous combustible properties, coal cannot be stored for a long time.

Cement and steel are definitely not transported in vessels similar to coal or throughout the year. Our rivers do not have all-season navigability. Even transportation of diesel and fertiliser by inland river often poses serious problems. Hence all such imported coal-based power plants planned for setting up inland will possibly be in danger of facing supply shortage in dry season.

While we appreciate PDB’s plans for fuel diversification for power generation, we do not consider that its plans for setting up power plants using imported coal is based on sound logic or detailed economic analysis. Given the volatility of the global coal market and absence of required infrastructures for coal import, the implemetation of this policy may turn out to be impractical. The government should instead concentrate on mining of our own coal and start setting up of large coal-based power plants with our own coal.

Engr Khondkar Abdus Saleque (Peng & FIEB) can be reached at Email: [email protected]

Khondkar Abdus Saleque.